One Big Circle

Your intelligent video team

We created AIVR – Trailblazing rail monitoring technology.

There are many benefits to our AI-powered remote monitoring technology which is trained to highlight priority issues within engineering and safety across the railway.

Learn more about AIVRKey Features

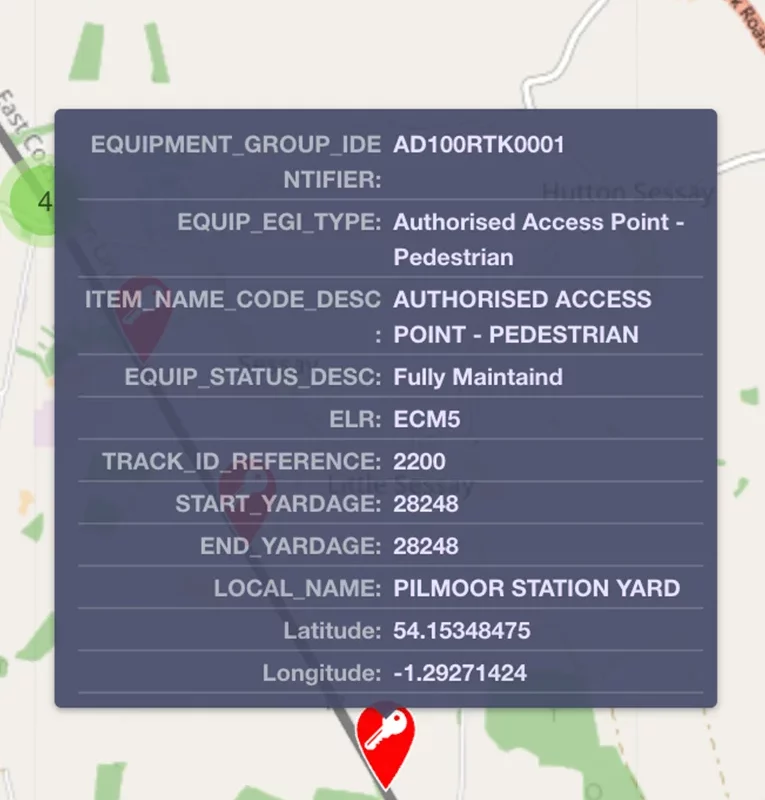

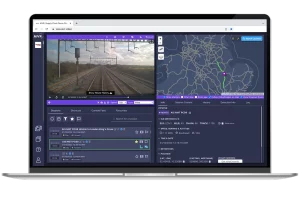

Browser-based AIVR Platform

As a browser-based platform, users have full accessibility to AIVR without the need to download any software package or system. AIVR users can simply load our website on any up-to-date web browser and log in to easily access the wealth of powerful data available, wherever you need it.

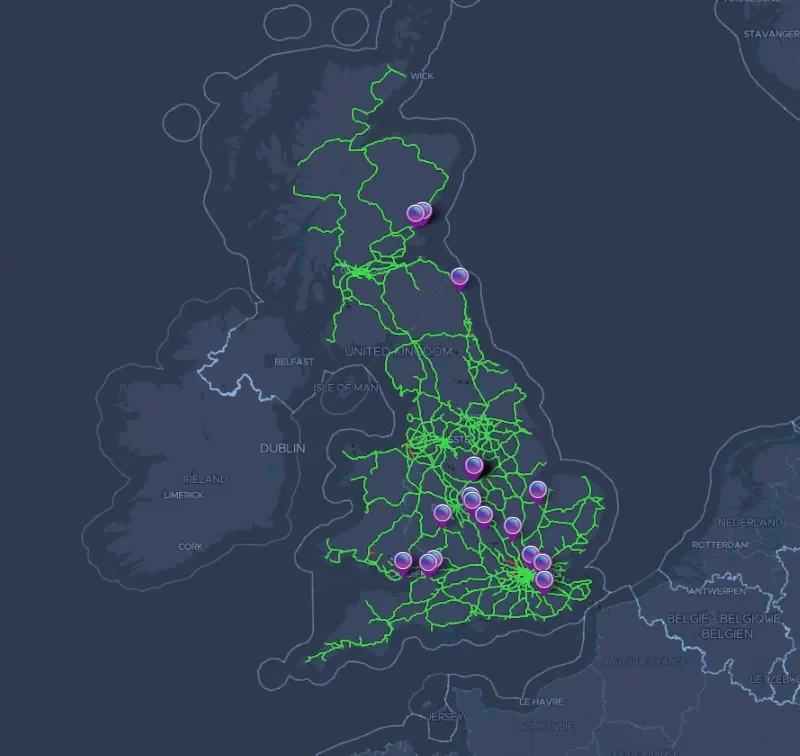

Largest Rail Video Data Platform with Integration Capability

AIVR hosts over a petabyte of footage captured across the breadth of the UK rail network, making it one of the largest train video data archives.

Thermal Imagery

AIVR Thermal records high-resolution infrared video footage along the conductor and running rail to provide you with a comprehensive overview of the condition of the track. AIVR Thermal uses advanced Machine Learning capabilities to ensure high temperature areas – ‘hotspots’ – are automatically identified within the platform to alert users to potential faults in rapid time.

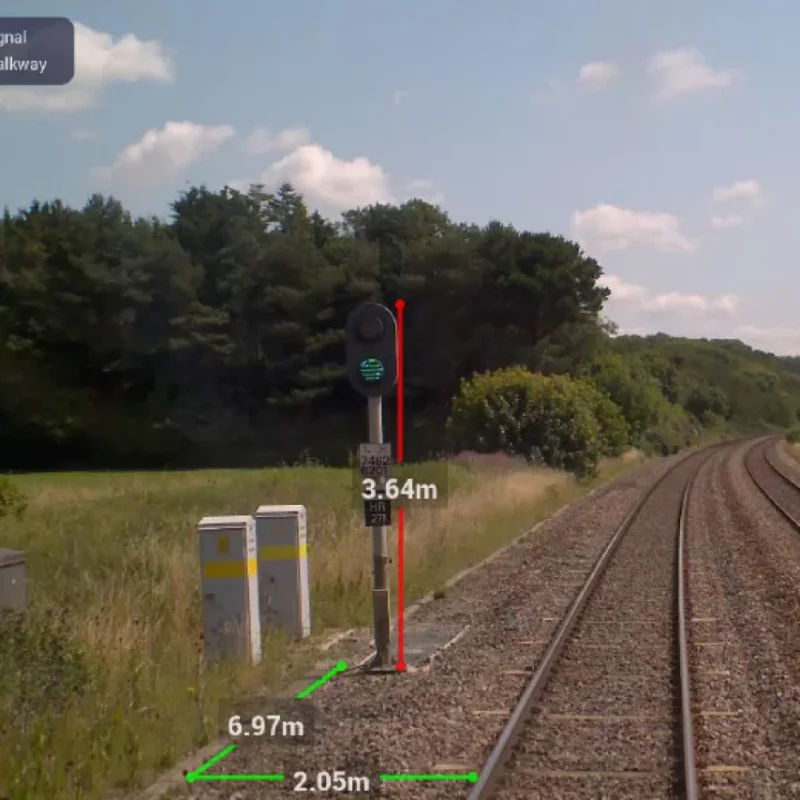

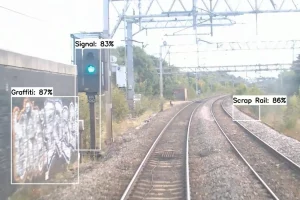

Artificial Intelligence / Machine Learning

AIVR enables training datasets to be created which in turn allows crucial information or potential issues to be easily identified through Machine Learning and AI. Our approach involves working closely with rail experts and end users to build this capability to provide insight and solve real world challenges.

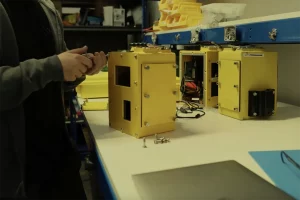

End-to-end Solutions Built In-House

One Big Circle’s dedicated Software, Hardware, and Delivery teams conceive and develop the full scope of technology used in AIVR solutions; hardware and software is designed and tested from our Bristol-based offices, within our in-house lab space.